In order to ensure the health and safety of our students, the Office for International Students and Scholar (OISS) provides virtual and in-person services. Visit our OISS COVID-19 Frequently Asked Questions page to read more about how OISS is supporting students during the COVID-19 pandemic.

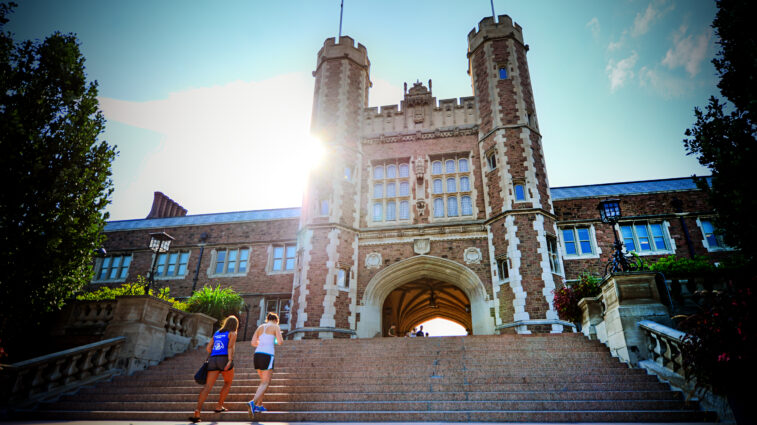

Welcome, international students!

The OISS is here to support international students during their time at Washington University in St. Louis. Our services include immigration advising, orientation to the WashU and St. Louis communities, and other programs to help students thrive academically and socially and engage them in U.S. life and culture. This website has information and resources for international students enrolled in full-time in degree programs at WashU, international exchange students, and international alumni.

International Scholars: The OISS also supports international scholars, including faculty members, research associates, postdoctoral research fellows, visiting scholars or physicians. If you are an international scholar, please visit our OISS International Scholars website.